Content

Because our content is not financial advice, we suggest talking with a professional before you make any decision. MoneyLion is a pay advance app stacked with features — and hefty fees to match. We’ve lined up 6 alternatives to help you go easy on your wallet. Many pay advance apps don’t work with this online bank — but here are six that do. And while they can be expensive, pawn loans let you put up valuables you may have around the house as collateral. But you won’t have access to what you use again until after you pay back the loan in full — plus any fees.

- Otherwise, alternative lenders are available on the Internet and also issue extra cash.

- Credit Unions are one of the widespread places for getting financial help.

- Find more information on our Payday Loans Direct Lender section.

You’ll need to compare things like minimum income, employment terms, Centrelink eligibility and whether the lender does a credit check. You can also get an idea of the repayments using the tables given on the page. Maximum loan amounts are low compared to other lenders, but the low minimum amount and flexible repayment terms make it an accessible option for borrowers. However, as with many loans for subprime borrowers, Avant personal loans come with a price. Still, the platform earns top marks for borrowers with less than stellar credit who need quick access to funds. Many of the providers offer amounts that range from $100 to $5,000, ensuring you’re able to receive the exact sum that you require.

What If I Am Not Able To Repay My Loan?

However, states under the hybrid practices will have the BadCreditLoansArranged.co.uk number of loans you can hold at once limited. But for most states, you can hold as much as you are granted. You must be aware of the APR your lender is charging you for your sake. It would be best to ask questions about it during the conversation with your lender. If you ignore the conversation about this, you might have to pay beyond your means.

Q What Are The Primary Requirements Of A Payday Loan?

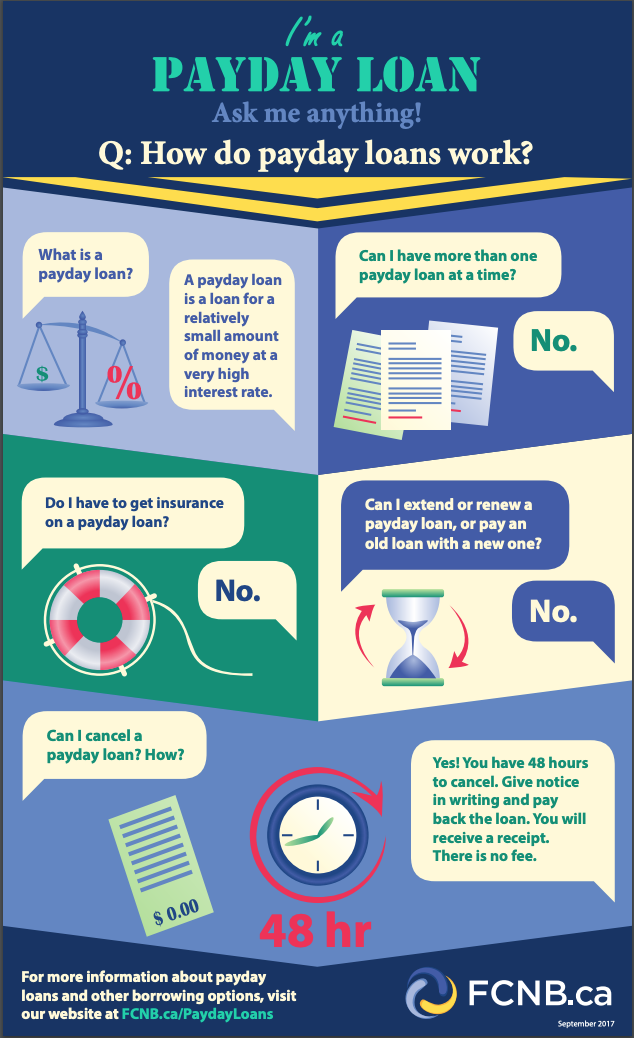

It also offers pathways to improved credit scores via on-time payments and the like. One of the more established payday loan lenders, Check Into Cash operates smaller loan amounts and deals directly with customers for their cash needs. The stores also offer check cashing too, which is a neat bonus. Find the best payday loans online and have access to the cash you need with no credit check. A payday loan is a type of short-term borrowing where a lender will extend high-interest credit based on your income.

If you need $300 urgently, the best option to get it is to take an online payday loan from direct lenders or through an app that has a broad base of payday lenders. Generally, such loans are granted until your next paycheck and often do not exceed the $500 limit. Most lenders will notify you of a decision a few minutes after you submit your application.

We Reviewed Over 130 Short

In order to qualify for a 1-hour payday loan, you must inhabit the fresh new You.S., keeps a bank checking account, and start to become old 18 or over. If you see these conditions, the financial institution will determine the amount of money you could potentially use dependent on your earnings or other points just like your credit score. The amount a customer can borrow will be subject to two factors – how much the lender sees fit to lend without incurring a huge amount of risk and the maximum loan limits set by each state. In most states, a customer can usually take out a payday loan for anything between $50 and $1,000. Once the paperwork is in order, the money will be transferred to the customer, typically electronically into their checking account. This can take a matter of hours or sometimes up to two business days.

Am I Eligible To Apply For A Quick Loan Online?

If approved, you can receive the funds the same day you apply or within 24 hours. As of now, what I can suggest is for you to check your options above. Use our table to compare your options based on maximum loan amount, turnaround time, and others. You can then click on the “Go to site” green button of your chosen lender to learn more.

Some federal credit unions offer PALs between $200 and $1,000 to all credit types. APRs are capped at 28% and terms range from one to six months. But you need to be a member of the credit union for at least a month to qualify. How much you can borrow depends on the state you’re in, but most lenders offer loans between $100 to $1,000. Payday loans have a high APR, but it isn’t because of a high interest rate.